The sales outlook for January was strong for electromechanical/connector products.

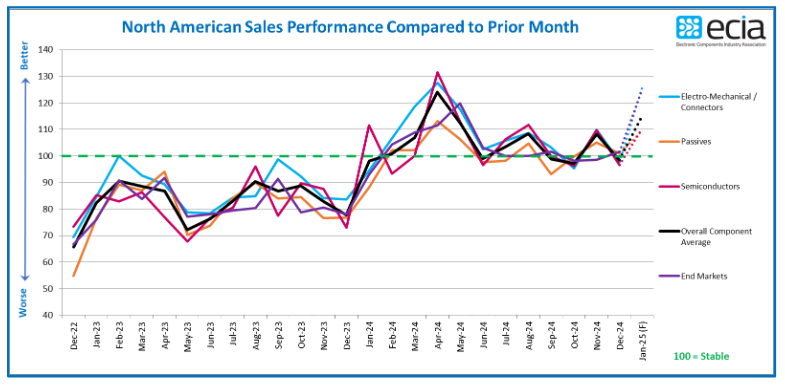

The December 2024 ECST survey of supply chain participants found that concerns about December sales eased compared to the November outlook. The November survey predicts an overall index score of 94.4, which is the highest level since December 2023. The actual results of the December survey showed that concerns eased, with an actual score of 98.4, a significant decrease from November but unchanged from previous months. Passive components are a category that scored over 100 in December, with a score of 101.0. The encouraging news comes from the January 2025 outlook, which predicts a jump of 16.8 points for an overall score of 115.2.

The outlook for January 2025 is in line with the optimistic view of sales improvement in the quarter of 2025 in the quarterly ECST survey conducted in November. Looking at the historical pattern of ECST score changes from December to January, January saw a significant increase after the usually slow December. Over the past five years, the average increase from December to January was 14.5%. The outlook for January from the December survey is consistent with the situation of the past five years. However, this jump is not always guaranteed. The increase in January 2022 was only 2.2 percentage points. Despite a slow start to 2022, the electronic components industry grew by more than 20% overall throughout the year. This will show that while the survey is a sound indicator of recent sales patterns, it does not reliably predict long-term results.

The strong sales outlook for January is for electromechanical/connector products, which are expected to score 125.7 points, a sharp increase of 27.9 points from December. The outlook index for semiconductor products was 110.3 points in January, only to return to the level of November 2024, while plummeting to 96.6 points in December. The Passive Components Index is forecast for January at 109.6 on a December basis.

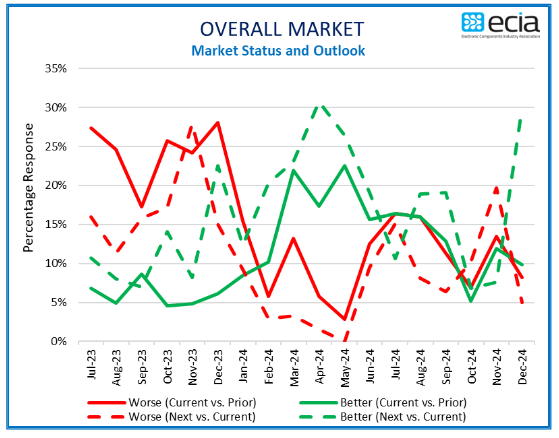

Comparing the survey results of the three groups of respondents, distributors expressed optimism, while manufacturer representatives were pessimistic. Manufacturers are generally consistent with the overall average results of the survey. The actual results of terminal market confidence in December were significantly higher than the forecast of the November survey. The index for December came in at 101.6, 13.8 points higher than expected.

The outlook for the end market in January is brighter, with an overall forecast of 125.0. The Avionics/Military/Space & Industrial Electronics markets** have forecast scores of 145.8 and 135.6 respectively in January, and all but one market are expected to exceed 100 in January. Only the consumer electronics market was below 97.8 in the January forecast. Ironically, January kicked off with the Consumer Electronics Show (CES), and the early vibes were quite positive. In addition, in the survey, the delivery time continues to be dominated by stable expectations.

Note: The source and copyright of the article belong to international e-commerce